When we talk about personal finance, a lot of terms often get tossed around: APRs, credit scores, mortgage principles … you get the idea. It’s easy to get lost in all of these numbers, so we’re here to break it down for you. These five may be the most important – they’re the difference between a healthy bank account and debt collectors knocking at your door.

1. Your credit score. This may be the most important number ever attached to your name. Your credit score decides your approval for a mortgage or auto loan; it also plays a role in what credit card offers you qualify for. It influences your rates on loans too, and much more. Moreover, many employers evaluate an applicant’s score during the hiring process.

To build a high score, you have to be a responsible borrower. That job is a little more complex than it might sound, so we’ll start at the beginning: Pay your credit card bills on time and in full.

Once you’ve got that down, another way to boost your credit score is to take out different types of loans to show you’re creditworthy.

That said, don’t take out all those loans at the same time, as each results in a hard inquiry, which takes a slight hit on your credit score. Your length of credit history has an impact on your score, and too many accounts opened at the same time may not look too good.

2. Your tax rate. When you file your taxes, you’ll find yourself in one of six brackets. Don’t assume, though, that if you fall into the 15 percent bracket, you pay a flat 15 percent to the federal government every year — you’ll pay less. That’s because the 15 percent bracket isn’t your effective rate (the final amount you end up paying); it’s your marginal tax rate, which says how much your last dollar is taxed.

Here’s why this is important: If your employer withholds significantly more than you owe to the federal government, you might ask them to withhold a little less. That way, rather than get the extra cash back as a federal tax return in springtime, you can deposit the money into a savings account or save it for retirement by depositing it into an Individual Retirement Account (IRA).

3. Your personal savings rate. In America, saving a large portion of your earnings may be a thing of the past. The personal saving rate — how much of your disposable income is socked away rather than spent — is at just about 4.6 percent.

While this is much improved, it still represents a major decline from decades past, when Americans overall saved more than 10 percent of their income. According to the Federal Reserve, just 52 percent of Americans spent less than they earned.

If you’re looking to save, check out your local credit union like First Financial! We offer a great variety of options in savings accounts and savings certificates.

4. Your student loan debt. Americans hold more debt in student loans than in credit cards, to the tune of $1 trillion. Although rates on most federal and private loans are less than those for credit cards, the sheer amount of debt — sometimes as much as $100,000 or more — can make it difficult to afford even the minimum payments. Be sure to know your future obligations when taking out student loans, and take advantage of any beneficial repayment programs offered by your lenders.

You need to get a handle on your student debt, as it will affect the loans you take out in the future. The way you treat your student debt, and really any debt, has a bearing on your credit score, which in turn has a bearing on your future rates — or if you’ll be approved for a loan at all.

5. Your net worth. It sounds daunting to try to put a dollar value to your name, but knowing this value will help you set smarter goals and create a sound financial plan. To calculate your net worth, you need to make a list of everything you own, everything you owe, and then subtract to find out the difference.

5. Your net worth. It sounds daunting to try to put a dollar value to your name, but knowing this value will help you set smarter goals and create a sound financial plan. To calculate your net worth, you need to make a list of everything you own, everything you owe, and then subtract to find out the difference.

First, add up your assets, then your liabilities (or your total debts). Your rough net assets equation should be as follows:

Net worth = (cash + properties + investments) – (credit card debt + loans + outstanding payments of any other kind).

If you’re in the positive, ask yourself: “Am I allocating my resources as best I can to my short, medium, and long-term goals?” If all of your money is sitting in a low-yield savings account, consider investing a portion of it to diversify your portfolio. The Investment & Retirement Center located at First Financial, can help you do just that.*

If you’re in the negative, don’t stress – but rather develop a plan. The most important step you can take is to begin paying off your debt as soon as possible, starting with the loans that have the highest rates. Once you know where you stand overall, you can budget better for future expenses, such as preparing to buy a car or saving for retirement.

*Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker/dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. First Financial Federal Credit Union (FFFCU) and First Financial Investment & Retirement Center are not registered as a broker/dealer or investment advisor. Registered representatives of LPL offer products and services using First Financial Investment & Retirement Center, and may also be employees of FFFCU. These products and services are being offered through LPL or its affiliates, which are separate entities from and not affiliates of FFFCU or First Financial Investment & Retirement Center.

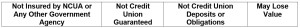

Securities and insurance offered through LPL or its affiliates are:

Article Source: http://money.usnews.com/money/blogs/my-money/2013/03/18/whats-your-number-5-financial-figures-you-need-to-know

There are a lot of different kinds of credit out there. One of the most common forms is the auto loan. Though we are all itching to pay off our long-term debts and own something free and clear, there are a few precautions to know about before racing to get that statement to read zero.

There are a lot of different kinds of credit out there. One of the most common forms is the auto loan. Though we are all itching to pay off our long-term debts and own something free and clear, there are a few precautions to know about before racing to get that statement to read zero.