Losing a loved one is never easy. In addition to the emotional challenges you may face, you might also be worried about what will happen to their debt once they are gone. Generally, with limited exceptions, when a loved one dies you will not be liable for their unpaid debt. Instead, their debt is typically addressed through the settling of their estate.

How are debts settled when someone dies?

The process of settling a deceased person’s estate is called probate. During the probate process, a personal representative (known as an executor in some states) or administrator if there is no will, is appointed to manage the estate and is responsible for paying off the decedent’s debt before any remaining estate assets can be distributed to beneficiaries or heirs. Paying off a deceased individual’s debt can significantly lower the value of an estate and may even involve the selling of estate assets, such as real estate or personal property.

Debts are usually paid in a specific order, with secured debt (such as a mortgage or car loan), funeral expenses, taxes, and medical bills generally having priority over unsecured debt, such as credit cards or personal loans. If the estate cannot pay the debt and no other individual shares legal responsibility for the debt (e.g., there is no cosigner or joint account holder), then the estate will be deemed insolvent and the debt will most likely go unpaid.

Estate and probate laws vary, depending on the state, so it’s important to discuss your specific situation with an attorney who specializes in estate planning and probate.

What about cosigned loans and jointly held accounts?

A cosigned loan is a type of loan where the cosigner agrees to be legally responsible for the loan payments if the primary borrower fails to make them. If a decedent has an outstanding loan that was cosigned, such as a mortgage or auto loan, the surviving cosigner will be responsible for the remaining debt.

For cosigned private student loans, the surviving cosigner is usually responsible for the remaining loan balance, but this can vary depending on the lender and terms of the loan agreement.

If a decedent had credit cards or other accounts that were jointly held with another individual, the surviving account holder will be responsible for the remaining debt. Authorized users on credit card accounts will not be liable for any unpaid debt.

Are there special rules for community property states?

If the decedent was married and lived in a community property state, the surviving spouse is responsible for their spouse’s debt as long as the debt was incurred during the marriage. The surviving spouse is responsible even if he or she was unaware that the deceased spouse incurred the debt.

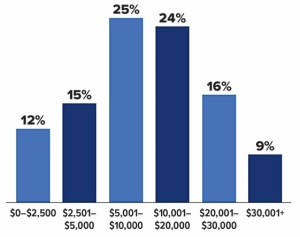

How much debt Americans expect to leave behind when they die:

Source: Debt.com Death and Debt Survey, 2024

What if you inherit a home with a mortgage?

Generally, when you inherit a home with a mortgage, you will become responsible for the mortgage payments. However, the specific rules will vary depending on your state’s probate laws, the type of mortgage, and the terms set by the lender.

Can you be contacted by debt collectors?

If you are appointed the personal representative or administrator of your loved one’s estate, a debt collector is allowed to contact you regarding outstanding debt. However, if you are not legally responsible for a debt, it is illegal for a debt collector to use deceptive practices to suggest or imply that you are. Even if you are legally responsible for a debt, under the Fair Debt Collection Practices Act (FDCPA), debt collectors are not allowed to unduly harass you.

Finally, beware of scam artists who may pose as debt collectors and try to coerce or pressure you for payment of your loved one’s unpaid bills.

Questions about this topic or looking to get started with estate planning? Contact First Financial’s Investment & Retirement Center by calling 732.312.1534. You can also email mary.laferriere@lpl.com or maureen.mcgreevy@lpl.com

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker/dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. First Financial Federal Credit Union (FFFCU) and First Financial Investment & Retirement Center are not registered as a broker/dealer or investment advisor. Registered representatives of LPL offer products and services using First Financial Investment & Retirement Center, and may also be employees of FFFCU. These products and services are being offered through LPL or its affiliates, which are separate entities from and not affiliates of FFFCU or First Financial Investment & Retirement Center.

Securities and insurance offered through LPL or its affiliates are:

The information provided is not intended to be a substitute for specific individualized tax planning or legal advice. We suggest that you consult with a qualified tax or legal professional. LPL Financial Representatives offer access to Trust Services through The Private Trust Company N.A., an affiliate of LPL Financial. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. CRPC conferred by College for Financial Planning. This communication is strictly intended for individuals residing in the state(s) of CT, DE, FL, GA, MA, NJ, NY, NC, OR, PA, SC, TN and VA. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2025.